If you’re an Irish business owner or entrepreneur, you may be aware of the importance of having a VAT (Value Added Tax) certificate. This document is crucial for companies to ensure they are compliant with tax regulations and can operate smoothly within the Irish market. In this blog post, we will guide you through the process of obtaining a VAT certificate for your business.

1. Determine if you need a VAT certificate

Before you start the process of obtaining a VAT certificate, determine whether your business requires one. In Ireland, businesses need to register for VAT if they meet specific thresholds. For example, if your annual turnover for supplying goods exceeds €75,000 or if your turnover for providing services exceeds €37,500, you’ll need to register for VAT.

2. Register for VAT with Revenue

The first step in obtaining a VAT certificate is to register with the Irish Revenue Commissioners, who manage the country’s tax and customs services. To do this, visit the Revenue website (www.revenue.ie) and navigate to the “VAT Registration” section. You’ll need to create a Revenue Online Service (ROS) account if you haven’t already. This account will allow you to manage your taxes and submit relevant forms online.

3. Complete the TR1 or TR2 form

After you have created your ROS account, download and complete either the TR1 or TR2 form, depending on your business type.

4. Submit the TR1 or TR2 forms

Once you have completed the appropriate form (TR1 for sole traders, partnerships, and unincorporated bodies or TR2 for companies), submit it to the Revenue Commissioners through your ROS account. Ensure that you provide accurate and complete information to avoid delays in the registration process.

5. Await approval and receive your VAT number

After submitting the form, the Revenue Commissioners will review your application. The processing time may vary, but you can generally expect a response within a few weeks. Once your application is approved, you will receive a VAT number. This number is unique to your business and will be used in all VAT-related transactions and documentation.

6. Obtain your VAT certificate

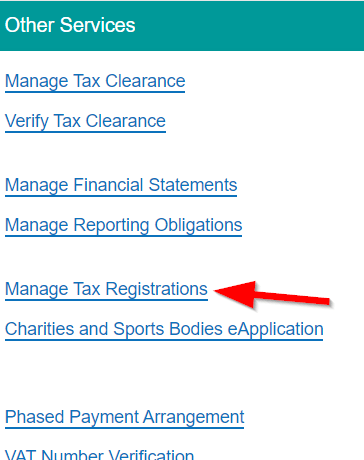

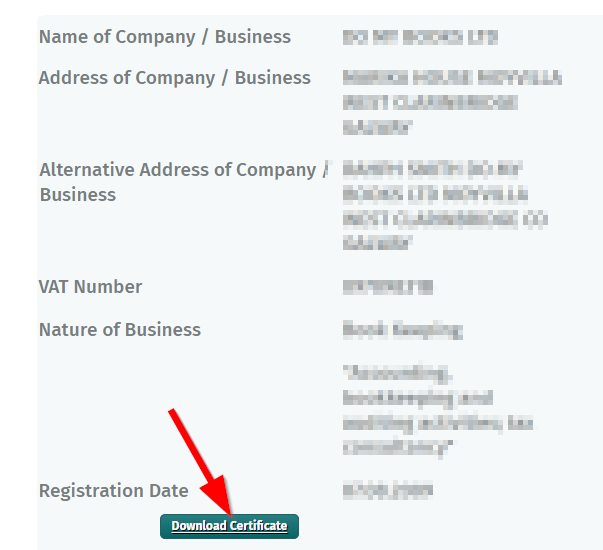

Once you have your VAT number, you can request a VAT certificate from the Revenue Commissioners. The certificate serves as proof that your business is registered for VAT in Ireland. It will contain essential information such as your business name, address, and VAT registration number. To request your VAT certificate, log in to your ROS account, and follow the instructions provided.

7. Display your VAT number and maintain records

After obtaining your VAT certificate, it’s crucial to display your VAT number on all invoices, receipts, and other business documents. This practice ensures transparency and compliance with tax regulations. Additionally, you should maintain accurate and up-to-date records of all VAT-related transactions to facilitate proper reporting and payment of taxes. (related: VIES / EU Vat Returns)

Navigating ROS and downloading your VAT certificate

DoMyBooks are a team of expert Galway Accountants offering complete tax, payroll and training services.