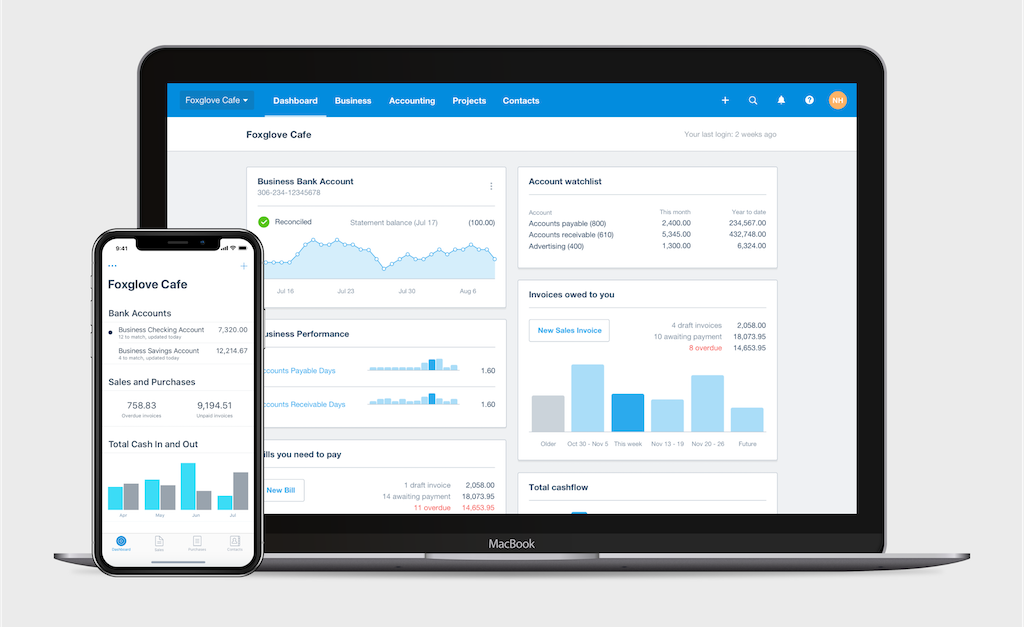

One of Xero’s most powerful features is its ability to generate clear and insightful financial reports. These reports give you a deeper understanding of your business’s financial health and help you make informed decisions. Here’s how to get the most out of Xero’s financial reports.

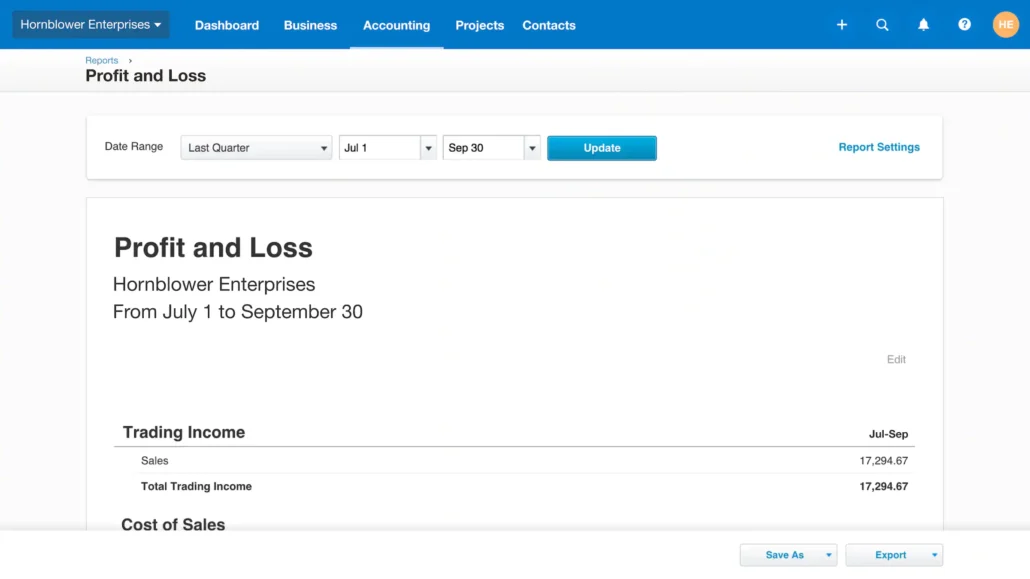

Profit and Loss Report

The Profit and Loss report, also known as the income statement, shows your revenue, expenses, and overall profit or loss over a specific period. Use this report to monitor your business’s profitability and track any financial trends.

Balance Sheet

Xero’s Balance Sheet provides a snapshot of your business’s assets, liabilities, and equity at a given moment. This report is crucial for understanding your company’s net worth and overall financial position.

Cash Flow Statement

Cash flow is the lifeblood of any business, and Xero’s Cash Flow Statement helps you track the inflows and outflows of cash in your business. Use this report to ensure you have enough cash on hand to meet your obligations.

Accounts Receivable and Payable

These reports provide a detailed look at the money you’re owed (Accounts Receivable) and the money you owe others (Accounts Payable). Monitoring these reports ensures that you’re on top of your invoicing and supplier payments.

Custom Reports

Xero also allows you to create custom reports tailored to your specific needs. Whether you want to focus on a particular aspect of your finances or track specific KPIs, Xero’s customization options let you build reports that suit your business.

By regularly reviewing these reports, you’ll have a clearer picture of your business’s financial health and be better prepared to make strategic decisions.