Xero is a powerful tool that can transform the way you manage your business finances, but many users aren’t fully tapping into its potential. Here are some top tips for small businesses to make the most out of Xero.

Use Bank Rules to Save Time

Set up bank rules to automatically categorise transactions based on the information imported from your bank. This will save you the time of manually assigning each transaction to a specific category.

Reconcile Transactions Regularly

By reconciling transactions daily or weekly, you can keep your financial data accurate and up to date. This practice will help prevent any unpleasant surprises at the end of the month or quarter.

Leverage Xero’s Mobile App

The Xero mobile app allows you to manage your business on the go. Use it to send invoices, track payments, and check your cash flow whenever you need to, from wherever you are.

Set Up Automatic Invoice Reminders

Xero’s automatic invoice reminders help you avoid the awkwardness of chasing late payments. Customise your reminders to send after a set number of days to gently nudge clients who haven’t paid yet.

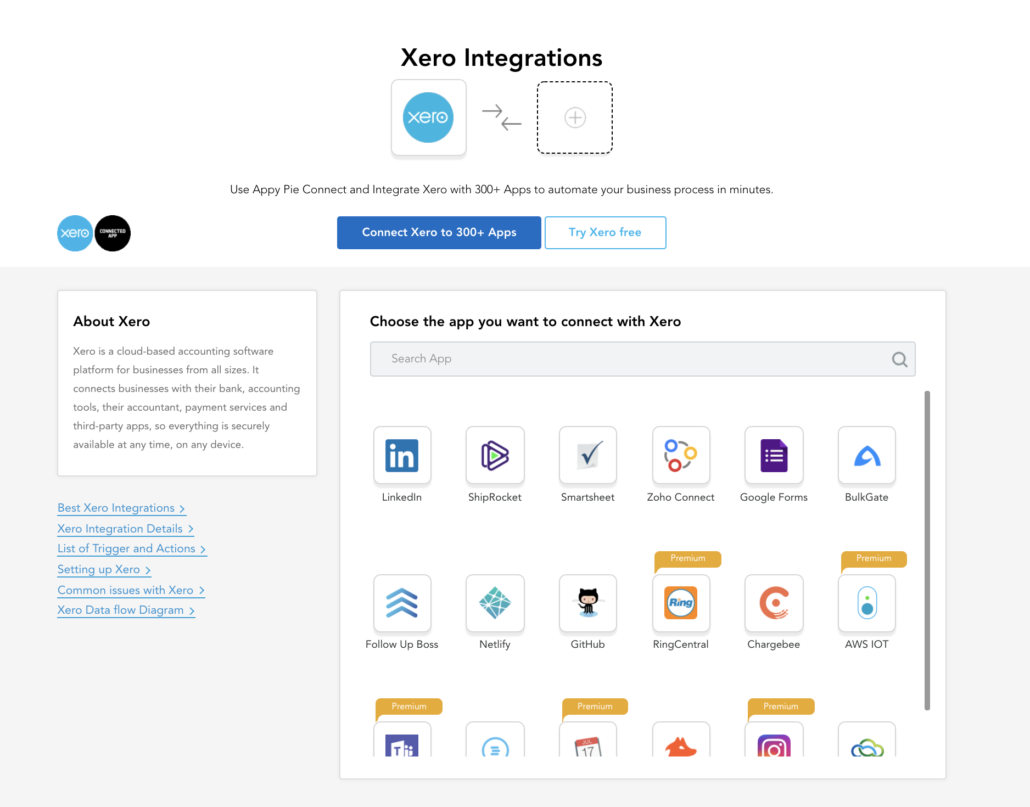

Integrate with Other Business Apps

By implementing these tips, small businesses can run more efficiently and stay on top of their financial health with Xero.